tax shield formula for depreciation

Par Value or Face Value P This is the actual money that is being borrowed by the lender or purchaser of bonds. Tax Shield Formula.

Tax Shield Formula Step By Step Calculation With Examples

The formula for depreciation under the straight-line method can be derived by using the following steps.

. 2 n 1. A company has a gross profit of 50000 with an operating expense of 15000 depreciation value of assets is 5000 and amortization of 5000. We know those income statement formulas are key parameters in analyzing the performance of any company but their drawback is that.

The LCOE methodology also considers various tax benefits including depreciation that may provide a tax shield. LCOE is a useful tool as it allows comparison of various generation technologies with different capital costs OM costs useful life etc. The factors are illustrated below.

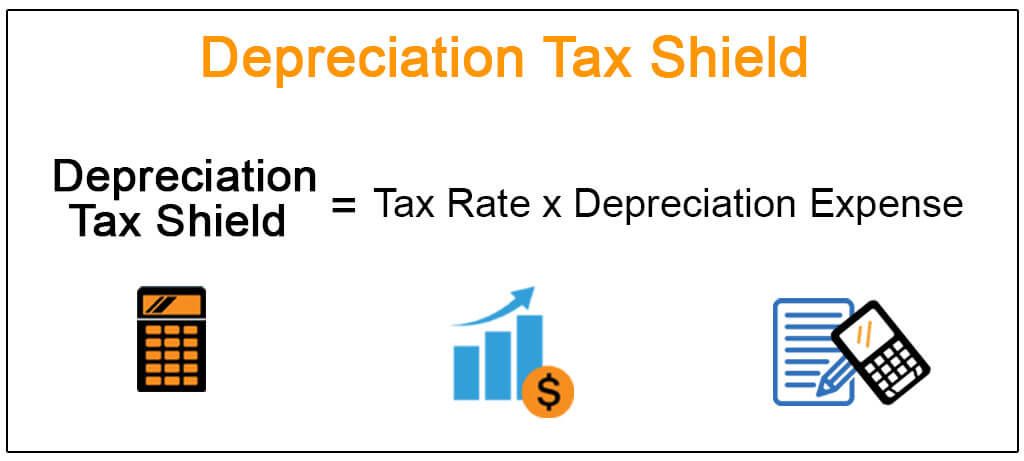

Degree of Financial Leverage 1167 times Financial Leverage Formula Example 3. The formula for exponential moving average can be derived by using the following steps. It is calculated by multiplying the tax rate with the depreciation expense.

Simple Interest Formula Example 2 ABC Ltd has taken a Long-term borrowing of INR 1000000 with an interest rate of 55 per annum from DCB Bank. LCOE can be viewed from an economic perspective as an average electricity price that. The formula to compute depreciation tax shield is as follows.

The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or produced in that particular cost pool. EBITDA Net Income Tax Expense Interest Expense Depreciation Amortization Expense 19000 19000 2000 12000 52000. Depreciation 560000 Explanation.

Dividends per Share Formula Annual Dividend No. Relevance and Use of Growth Rate Formula. The formula for Stockholders Equity Formula 1.

Depreciation tax shield Tax rate Depreciation deduction. Firstly decide on the number of the period for the moving average. Net Profit Margin 309 Things to Remember.

As can be seen from the Bond Pricing formula there are 4 factors that can affect the bond prices. A depreciation tax shield Depreciation Tax Shield The Depreciation Tax Shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. The effect of a tax shield can be determined using a formula.

In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula. The amount of tax that the annual depreciation of an entity saves is known as depreciation tax shield.

After 6 years and also find out the total amount Simple Interest paid by the Company at the end of tenure. Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. Get 247 customer support help when you place a homework help service order with us.

The annual tax deductible depreciation expense of a company is 50000 and its tax rate is 40. Then calculate the multiplying factor based on the number of periods ie. Net Profit Margin 90913600 2942425700 100.

Finally the growth rate formula can be obtained by dividing the change in value step 3 by the initial value step 1 of the metric and then express the result in terms of percentage by multiplying by 100 as shown below. Annual Dividend Total Dividend paid Special One-time Dividend. Assuming the same tax rate of 25 you would only have to pay 1705 in taxes.

In many countries an individuals income is divided into tax brackets and each bracket is taxed at a different rate. A firm has Equity Share Capital of Rs600000 consisting of 6000 shares of Rs100 each. Next figure out the cost of goods sold or cost of sales from the income statement.

Explanation of Bond Pricing Formula. Read more is a tax reduction technique under which depreciation expenses are subtracted from. Depreciation 2 35 million 070 million 10.

Accumulated depreciation can shield a portion of a businesss income from taxes. To increase cash flows and to further increase the value of a business tax shields are used. So as you can see real estate depreciation acts as a tax shield and reduces your taxable income.

Annual Dividend 202500 Therefore now we will calculate Dividends per share Formula. The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will eventually decrease all conditions being equal. Calculate their Earnings Before Interest Taxes Depreciation and Amortization.

Examples of Stockholders Equity Formula With Excel Template. Compared to 6250 thats about 4500 saved in taxes. Depreciation Tax Shield Example.

Effective Tax Rate Formula Example 1. Calculate the value of. Stockholders Equity Paid-Up Capital Retained Earnings Treasury Stock.

Generally it is 100 or 1000 per nay bond. For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Using the formula for accumulated depreciation the calculation for year 2 with the values filled in is.

Degree of Financial Leverage 1167 1. Stockholders Equity Total Assets Total Liabilities. Overhead Rate 8 per working hour Explanation.

This is derived from 25000 in rental income minus 18182 in depreciation expense. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Company XYZ accounts for their 12000 depreciation and amortization expense as a part of their operating expenses.

How to Calculate Double Declining Balance Depreciation. Growth Rate Final Value Initial Value Initial Value. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below.

Annual Dividend 250000-47500. So the accumulated depreciation for year 1 is 10000. Price Elasticity of Demand 4385 98.

Examples of Effective Tax Rate Formula With Excel Template Lets take an example to understand the calculation of Effective Tax Rate in a better manner. Let us take the example of a company ABC Ltd and calculation of capital expenditure in 2018 based on the following information. Calculate the simple interest paid by ABC Ltd.

Firstly figure out the net sales which are usually the first line item in the income statement of a company. The formula for Gross Margin can be calculated by using the following steps. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula How To Calculate Tax Shield With Example

What Is Depreciation Of Assets And How Does It Impact Accounting

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula Examples Interest Depreciation Tax Deductible